How to Create a New Tax Rate in Magento 2

July 17, 2022

- 2 min read

With Magento 2, you can create a lot of new tax rates based on different geographical areas (states or countries). Adding the tax rates is under the control of the “Tax Zones and Rates” tool to direct multiple taxes to a specific region. Based on the tax settings of the stores, the system will calculate the tax correctly for customer’s order after all order information are completed.

The tax rate is one of the important elements to create a tax rule. Let’s do the best with this guide from us.

Create a New Tax Rate in Magento 2

Setup a New Tax Rate in Magento 2

- On the Admin Panel, Stores > Taxes > Tax Zones and Rates.

- In the upper-right corner, click Add New Tax Rate.

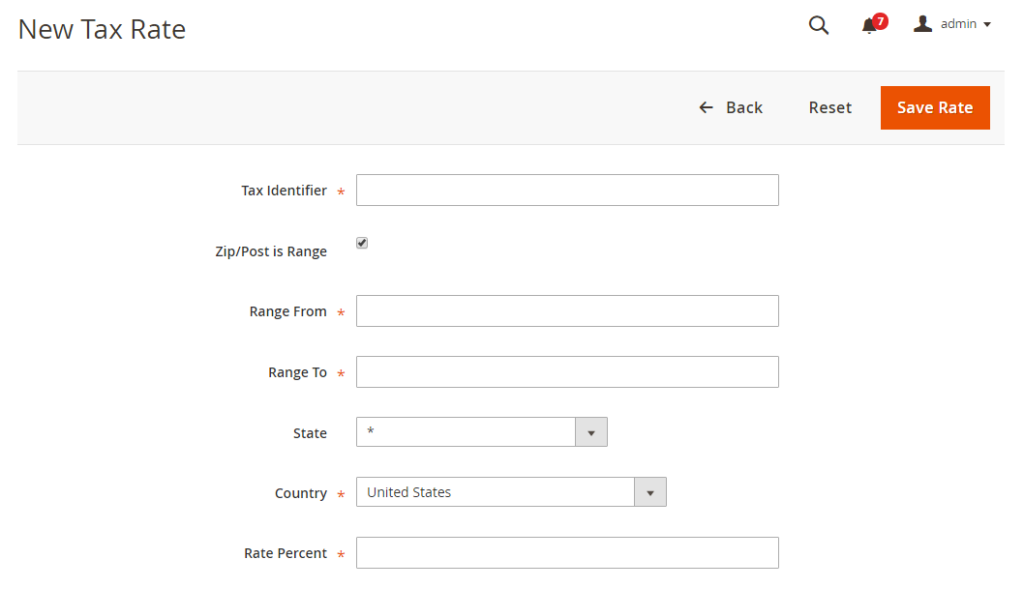

- Set Tax Identifier for the new tax rate.

- Insert the Zip/Post b to assign the new tax rate.

- The asterisk wildcard () can be used to match up to ten characters in the code. For example, 90 represents all ZIP codes from 90000 through 90999.

- To assign the tax rate to a range of ZIP or postal code, need to do:

- Tick the Zip/Post is Range checkbox.

- Type the first ZIP or postal code in the range.

- Type the last ZIP or postal code in the range.

- Select the State and Country where the tax rate applies.

- Set the Rate Percent to calculate the tax rate.

- Click Save Rate to complete.

Change an existing Tax rate in Magento 2

- On the Admin Panel, go Stores > Taxes > Tax Zones and Rates.

- Find the tax rate you need to edit in the Tax Zones and Rates grid.If there are many rates in the grid, use the filter to find.

- Modify any information as you need, and then click on Save Rate to complete.

Comment(s)

Please complete your information below to login.