How to Configure Value Added Tax (VAT) in Magento 2

Setting up VAT in Magento 2 is crucial for online businesses to ensure compliance and proper tax calculation for different regions. This guide walks you through the process step by step.

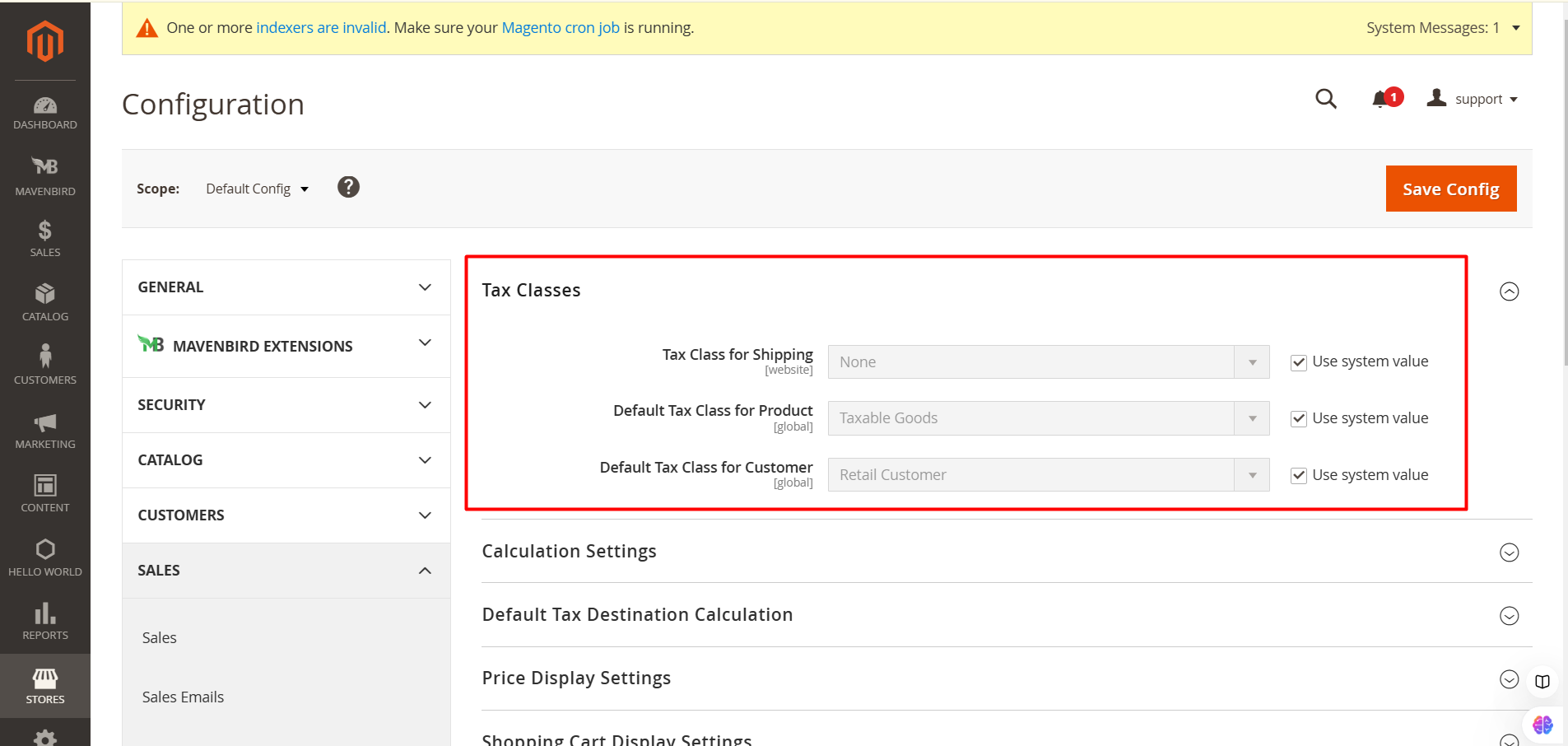

Step 1: Enable Tax Settings

Navigate to Stores > Configuration > Sales > Tax. Under the Tax Classes section, ensure that VAT-specific classes are enabled. You may define new classes such as:

- Product Tax Class: For products subject to VAT.

- Customer Tax Class: For customers with VAT exemption.

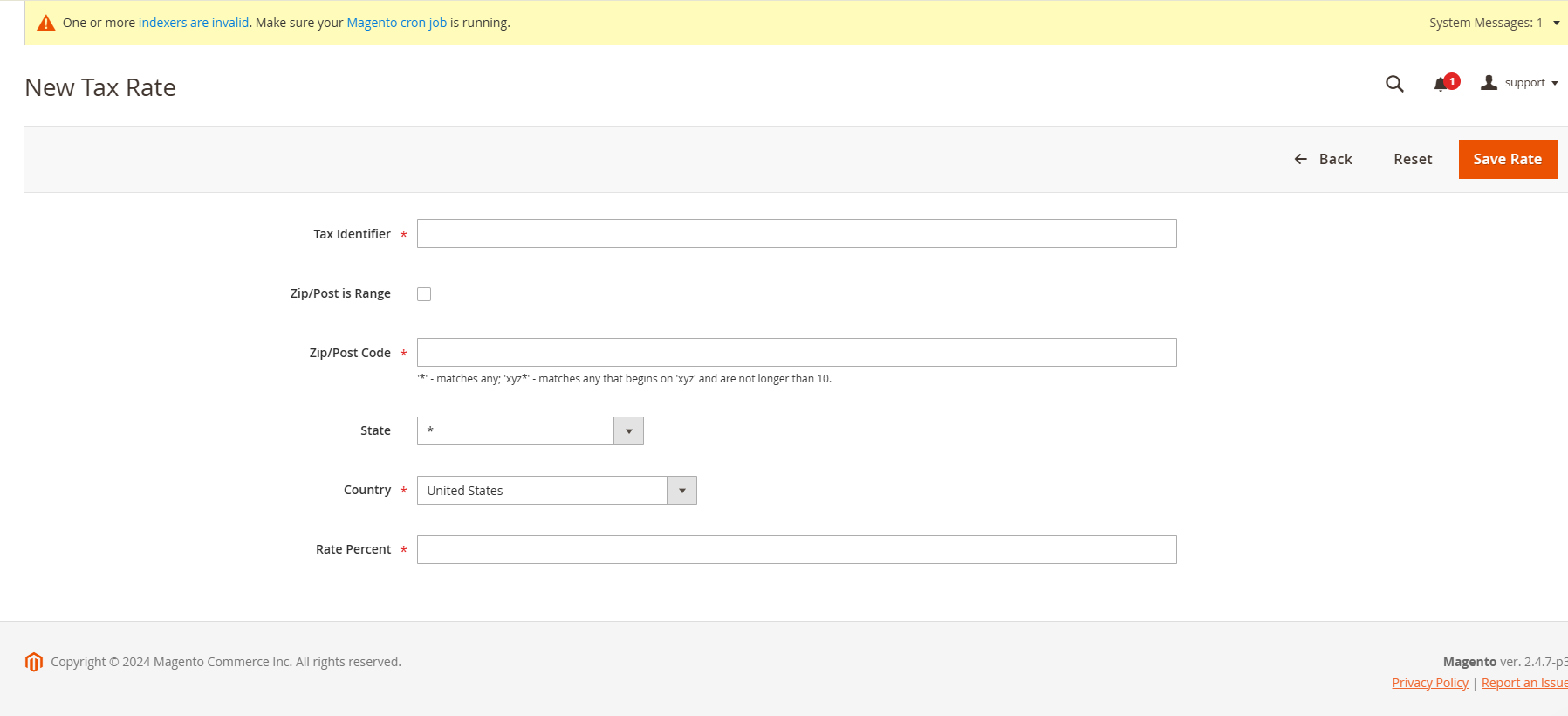

Step 2: Configure Tax Zones and Rates

In Stores > Tax Zones and Rates, click Add New Tax Rate to define VAT rates. Fill in details such as:

- Tax Identifier: A unique name for the VAT rate (e.g., VAT_20).

- Country: Select the applicable country.

- State/Region: Specify the region (or leave blank for country-wide).

- Zip/Post Code: Define zip codes or leave as '*' for all.

- Rate: Enter the VAT percentage (e.g., 20%).

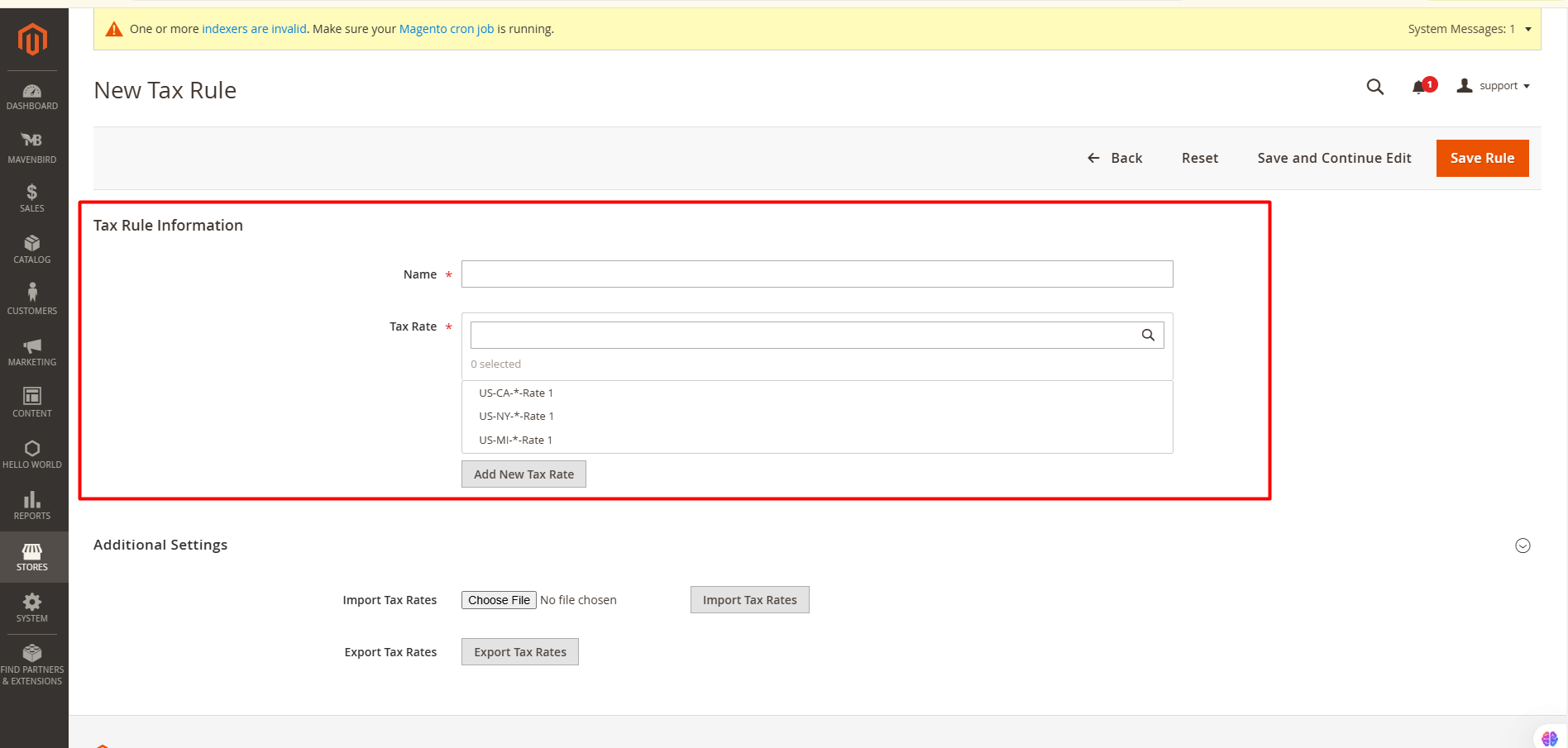

Step 3: Create Tax Rules

To apply VAT correctly, go to Stores > Tax Rules. Add a new tax rule with:

- Tax Rule Name: A descriptive name (e.g., "VAT 20% Rule").

- Tax Rate: Select the rate created in the previous step.

- Customer Tax Class: Choose the relevant class (e.g., "Retail Customer").

- Product Tax Class: Select applicable classes (e.g., "Taxable Goods").

- Priority: Set the priority if multiple tax rules apply.

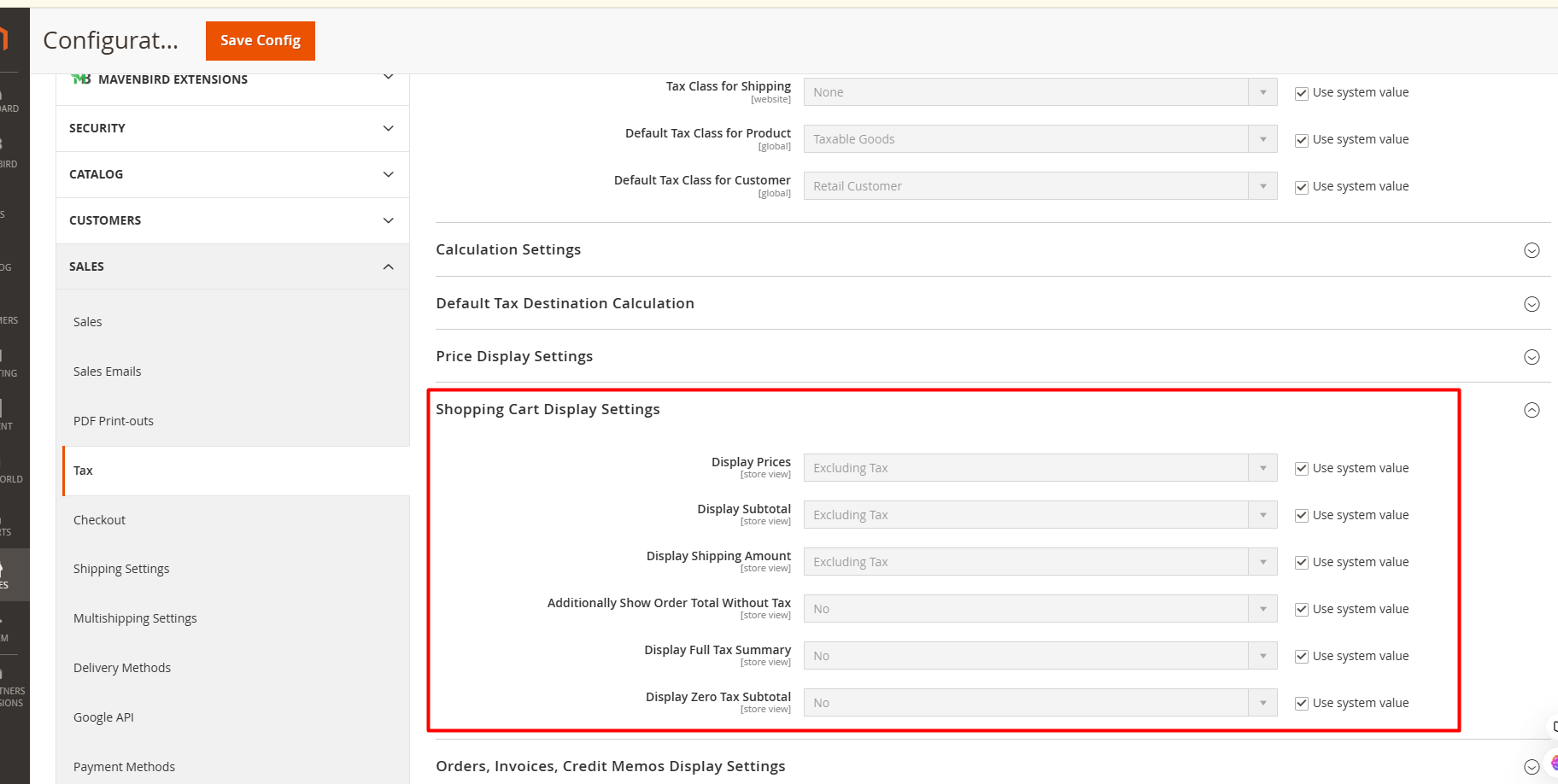

Step 4: Configure Display Settings

To configure how VAT is displayed on the storefront, follow this path: Stores > Configuration > Sales > Tax > Tax Display Settings. Adjust the following options:

- Display Product Prices In Catalog: Choose "Including Tax," "Excluding Tax," or both.

- Display Shipping Prices: Decide if shipping costs should include VAT.

- Include Tax in Subtotal: Enable to include VAT in order subtotals.

- Display Tax in Shopping Cart: Show VAT breakdown in the cart summary.

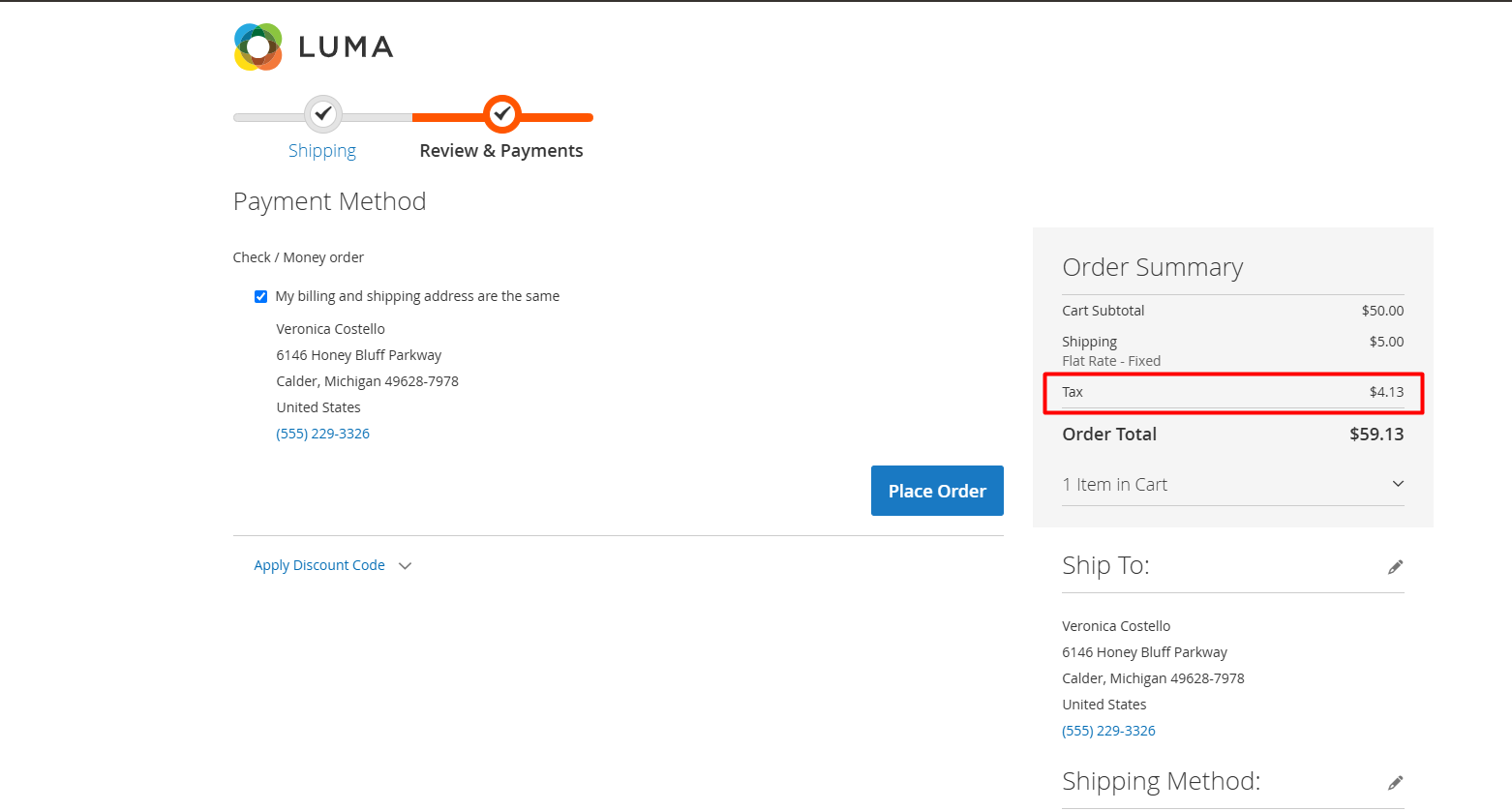

Step 5: Test the Configuration

Test your configuration by adding a taxable product to the cart and proceeding to checkout. Verify that VAT is calculated and displayed correctly for the specified regions.

Conclusion

Proper VAT configuration in Magento 2 is crucial for ensuring your online store remains compliant with tax regulations across different regions. By following the steps outlined in this guide, you can accurately apply VAT rates, display tax-inclusive prices, and ensure a smooth checkout experience for your customers. At Mavenbird, we understand the importance of seamless eCommerce management, and configuring VAT correctly is just one way to keep your operations running smoothly and avoid potential legal discrepancies. With these steps, you can ensure that your Magento 2 store is set up for success in handling taxes efficiently.

Please complete your information below to login.