How to Configure EU Tax in Magento 2

Tax is an important factor to be considered by online stores when they want to operate in several countries. The EU is a prominent region with a large customer base and potential growth, hence becoming a popular choice for merchants to expand their store to. In today’s EU Tax Configurations from Magento 2, you will follow the steps to set up the tax rules and rates on two store views: France and Germany. The guides are shown clearly to make sure that the tax rules and rates are correct to apply for your EU Tax in the allowed jurisdiction.

In addition to EU Tax, you also have a certain example about US Tax and Canadian Tax. Follow these links to get a deeper understanding about the tax rules and rates configuration on Magento 2 stores.

7 Steps to Configure EU Tax in Magento 2:

Step 1: Add Three Product Tax Classes

For this example, suppose that multiple VAT-Reduced product tax classes are not needed.

- Add a VAT-Standard product tax class.

- Add a VAT-Reduced product tax class.

- Add a VAT-Free product tax class.

Step 2: Add Tax Rates for France and Germany

Complete the requirement of creating a new tax rate. Remember to select the correct countries in EU as you need.

Step 3: Create the Tax Rules

Complete the requirement of creating a new tax rule. For example, you create the tax for Retail Customers.

Step 4: Create a Store View for France

Now you will create store views for each country:

- On the Admin Panel, Stores > Settings > All Stores.

- In the upper-left corner, create a store view for France. Then, do the following:

- On the Admin sidebar, Stores > Settings > Configuration.

- In the upper-left corner, set Default Config to the France store.

- On the left panel, under General, choose General, then open the Countries Options section, and set the default country to France.

- Fill out the information as you need.

Step 5: Create a Store View for Germany

- On the Admin Panel, Stores > Settings > All Stores.

- In the upper-left corner, create a store view for Germany. Then, do the following:

- On the Admin sidebar, Stores > Settings > Configuration.

- In the upper-left corner, set Default Config to the Germany store.

- On the left panel, under General, choose General, then open the Countries Options section, and set the default country to Germany”.

- Fill out the information as you need.

Step 6: Complete Tax Settings for France

Next, fill out details to set up tax for each country:

- On the Admin Panel, go to Stores > Settings > Configuration.

- On the left panel, under Sales, choose Tax.

- In the Tax Classes section, set the Tax Class for Shipping to “Shipping”.

- Open Calculation Settings workplace,

- In the Tax Calculation Method Based On field, allow calculating the tax on “Total” value of the order.

- “Including Tax” to the Catalog Prices and Shipping Prices.

- Allow including the discount amount by choosing “After Discount” in the Apply Customer Tax field.

- To tax for the discount, choose “Including Tax” in the Apply Discount on Prices field.

- In the Apply Tax On field, choose “Custom Price” (if available).

- Expand the Default Tax Destination Calculation section, you need to:

- Set Include Tax in Grand Total to “Yes”

- Apply the FPT when you choose “Yes” for Enable FPT.

- ” Including FPT and FPT description” for all settings of Price Display and Shopping Cart Display.

- Disallow applying discount to FPT by selecting “No” in the corresponding field.

- Set Apply Tax to FPT to “Yes”.

- To agree to include FPT in Subtotal, set the field to “Yes”.

Step 7: Complete Tax Settings for Germany

- On the Admin Panel, Stores > Settings > Configuration.

- On the left panel, under Sales, select Tax. Then, do the following:

- In the upper-right corner, set Store View to Germany.

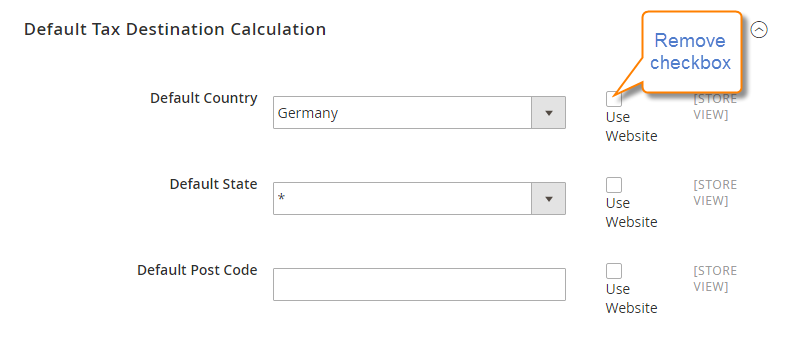

- Remove the Use Website checkbox that is in the right of the Default Country field, then enter Germany into the field.

- Remove the Use Website checkbox that is in the right of the Default State field, then leave “*” symbol into the field.

- Remove the Use Website checkbox that is in the right of the Default Post Code field, then leave “*” symbol into the field.

- Save Config to complete.

The bottom line

How to Configure EU Tax in Magento 2 tutorial hopefully gives stores like you timely support if EU countries are your target markets. We have shown you via the example of setting up tax for a store running in two countries: France and Germany, by creating two store views. You can follow that to apply to your own store, and if you need help, please leave comments below or ask us Good luck!

Please complete your information below to login.